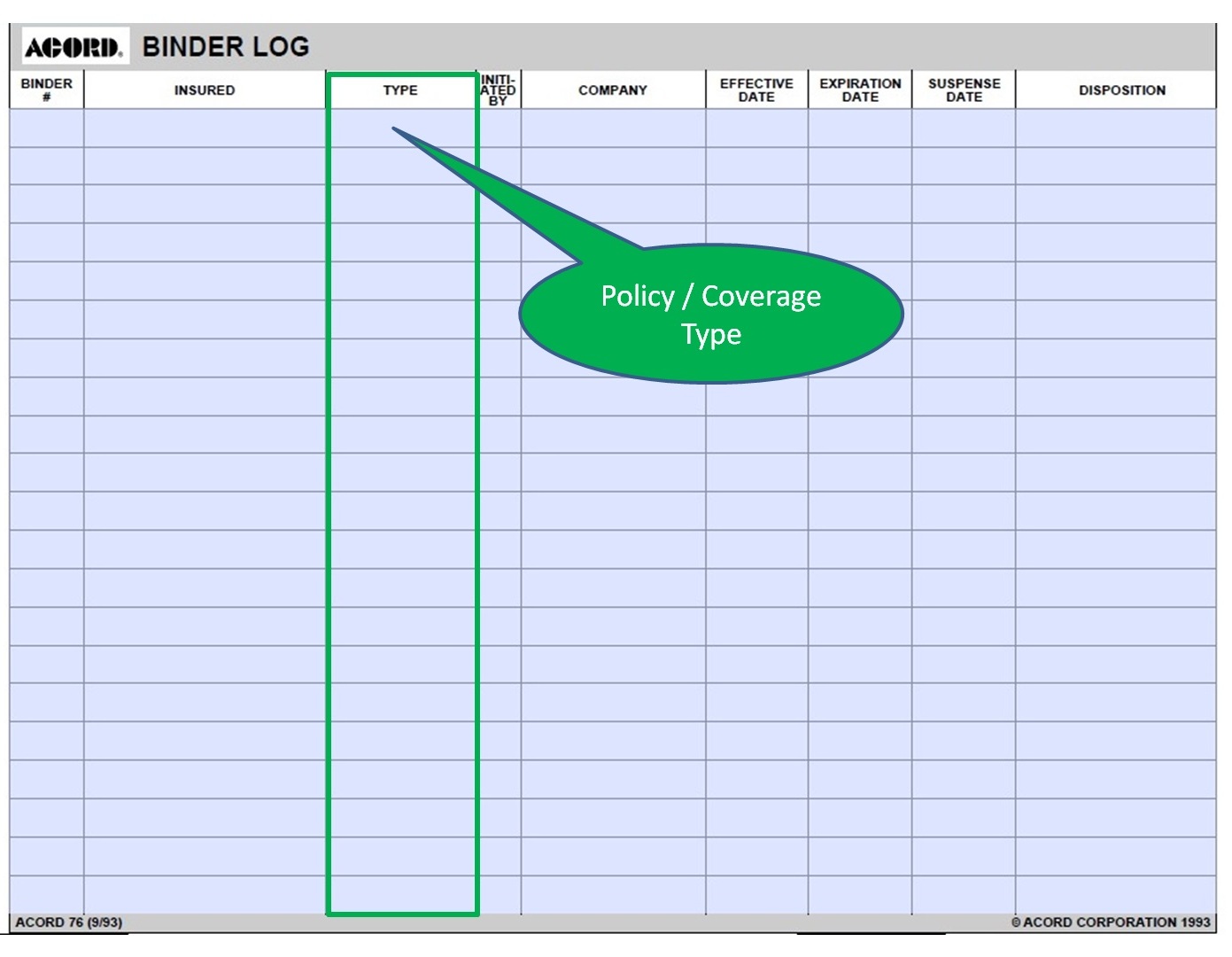

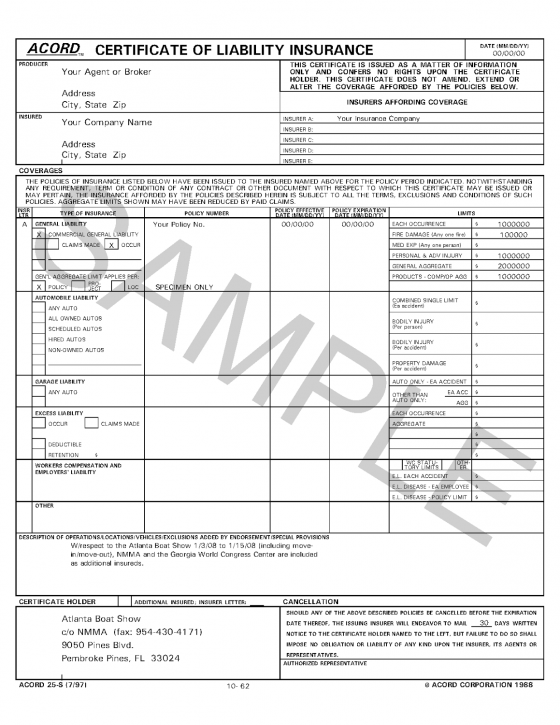

The insurance binder protects you after an accident and must file a claim before you receive your official insurance policy. The company grants binding powers to certain agents to help them issue policies faster. The company will then issue a conditional premium receipt to the applicant. In most cases, the applicant submits the application at the same time as the first payment of the premium. In the case of life insurance, agents can never bind the company. Representatives must be licensed in the state where the policy is to be issued and they must also have a specific power of attorney from the insurer to tie coverage to potential policyholders. The parties involved in entering into an insurance policy include the insured, an independent or exclusive insurance agent and the insurance provider. Other types of insurance policies available may also be: Read this article for more information on the different parts you will find in an insurance contract. Many insurance companies use a form issued by the Association for Cooperative Operations Research and Development called the ACORD Workbook Form, although some companies create and extract their own file. If the policy takes longer than 30 days to issue, the insurer may issue a revised file to keep the coverage intact until the policy is completed.

Workbooks are typically valid for 30 days, at which point the actual font should be issued. As long as your app meets certain requirements, you don`t need to wait for a human to approve it. When you purchase home insurance online, your coverage can often start immediately. Even computers can (in one way or another) have binding power. Click here to read a detailed definition of insurance contracts. The insurance file lists all the coverages for which you are covered while waiting for a new policy, as well as coverage limits, deductibles, fees and terms. People often need home and auto insurance records to prove insurance coverage when buying a home with a mortgage or a new car with a car loan.

In addition, insurance companies may use terms such as tie coverage or commitment insurance, which also means that the insurer is obligated or bound by a coverage agreement before the policy is issued. If an agent does not have this authority, they must ask someone else to approve the client`s request on their behalf. If an agent has binding power, it means that they are allowed to tie the insurance company to new policies without first seeking approval from the insurance company.

0 kommentar(er)

0 kommentar(er)